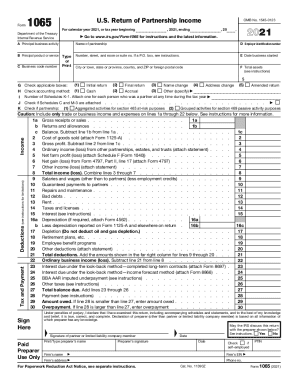

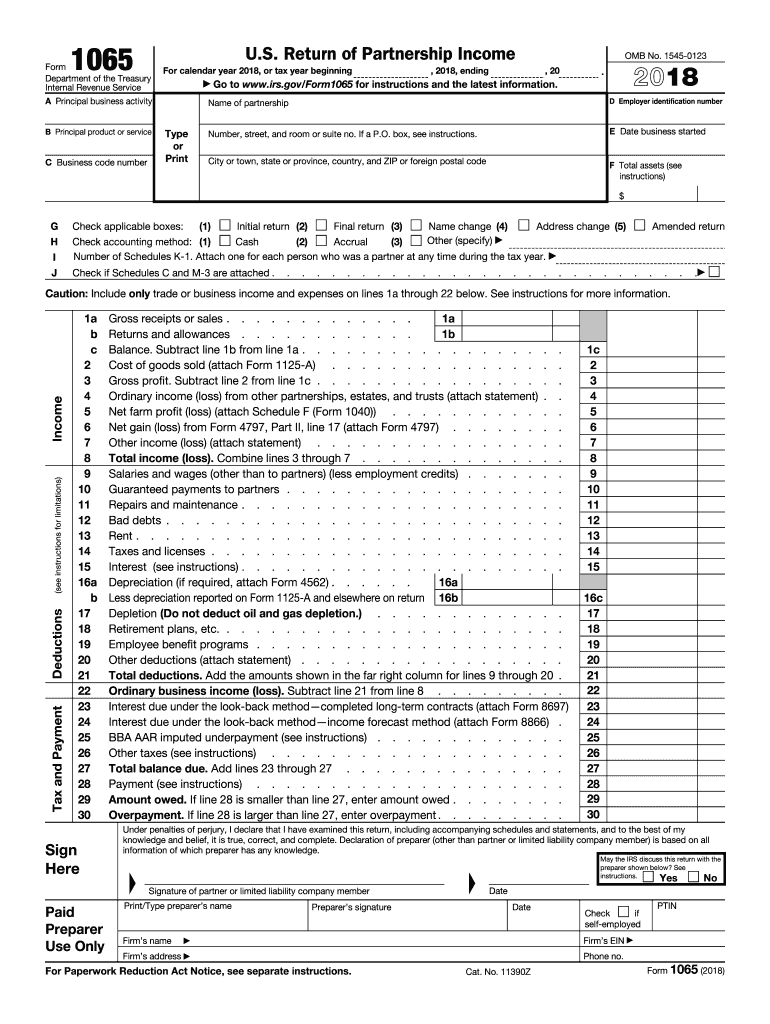

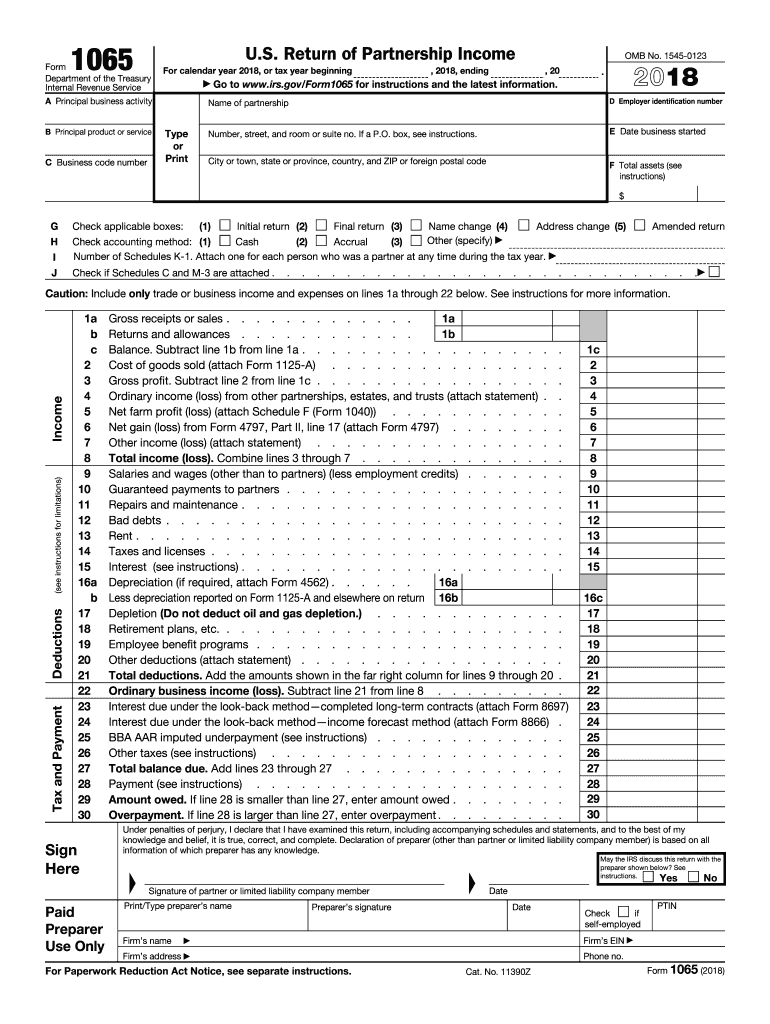

IRS 1065 2018 free printable template

Show details

6a 6b b Qualified dividends c Dividend equivalents 6c Royalties. Net short-term capital gain loss attach Schedule D Form 1065. Net long-term capital gain loss attach Schedule D Form 1065. Collectibles 28 gain loss. 9b Unrecaptured section 1250 gain attach statement. If Yes complete i through v below. i Name of Entity ii Employer Identification iii Type of Entity Organization v Maximum Percentage Owned in Profit Loss or Capital Does the partnership satisfy all four of the following conditions...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1065

Edit your IRS 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1065 online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1065. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1065

How to fill out IRS 1065

01

Gather necessary documents such as financial statements and partnership agreements.

02

Complete the top section of Form 1065, including the partnership's name, address, and employer identification number (EIN).

03

Fill out Part I to report income and deductions, including ordinary business income and other income.

04

Complete Schedule B to provide information about the partnership and partners.

05

Fill out Schedule K, which summarizes the partnership's income, deductions, and credits.

06

Prepare Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

07

Review the completed form for accuracy and ensure all required signatures are obtained.

08

Submit IRS Form 1065 by mail or electronically by the deadline, usually March 15.

Who needs IRS 1065?

01

Partnerships, including LLCs taxed as partnerships, that earn income and need to report profits and losses to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

What is a K-1 Form 1065?

Who needs to file a 1065? All partnerships in the United States must submit one IRS Form 1065 unless there was no income or expenditures for the year. The IRS defines a “partnership” as any relationship existing between two or more persons who join to carry on a trade or business.

What is the difference between a K-1 and a 1065?

Use Form 1065-X, if you are not filing electronically, to: Correct items on a previously filed Form 1065, Form 1065-B, or Form 1066. Make an Administrative Adjustment Request (AAR) for a previously filed Form 1065, Form 1065-B, or Form 1066.

Does everyone have a Form 1065?

This is generally April 15 for calendar year taxpayers. Most partnerships use the calendar year. The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

What is the difference between a K-1 and a 1065?

The K-1 form is also used to report income distributions from trusts and estates to beneficiaries. A Schedule K-1 document is prepared for each relevant individual (partner, shareholder, or beneficiary). A partnership then files Form 1065, the partnership tax return that contains the activity on each partner's K-1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 1065 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your IRS 1065 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out IRS 1065 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 1065 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit IRS 1065 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as IRS 1065. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is IRS 1065?

IRS Form 1065 is a tax return used to report the income, gains, losses, deductions, and credits of a partnership. It provides information about the partnership's financial activity during the tax year.

Who is required to file IRS 1065?

Partnerships and limited liability companies (LLCs) that are classified as partnerships for tax purposes are required to file IRS Form 1065. This includes multi-member LLCs and general partnerships.

How to fill out IRS 1065?

To fill out IRS Form 1065, partnerships need to provide their name, address, Employer Identification Number (EIN), and financial information such as income, deductions, and credits. The form includes sections for reporting income, deductions, and partner's share of income and deductions. It must be signed and filed by the partnership's designated partner.

What is the purpose of IRS 1065?

The purpose of IRS Form 1065 is to report the financial activities of partnerships to the IRS. It allows the IRS to track partnership income and distributions to partners, ensuring proper tax obligations are met by the individual partners.

What information must be reported on IRS 1065?

IRS Form 1065 requires the reporting of the partnership's income and deductions, types of income earned, guaranteed payments to partners, and the allocation of income and losses among partners. Additionally, partners' information, including their shares of income, deductions, and credits, must also be reported.

Fill out your IRS 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.